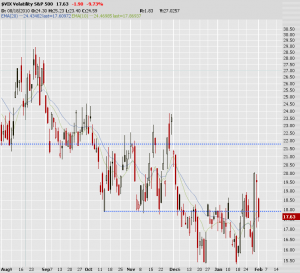

Needless to day, I am a bit skeptical to this last break of highs on the S&P500 why might you ask? Because of the VIX. The VIX is a measure of volatility in the markets, when volatility is high the VIX rises, when volatility is low, the VIX falls. As the old saying goes, “when the VIX is low, lookout below.” This is because we see the biggest crashes in the context of a bull market (low VIX) and the biggest rallies or short squeezes, in the context of a bear market (high VIX).

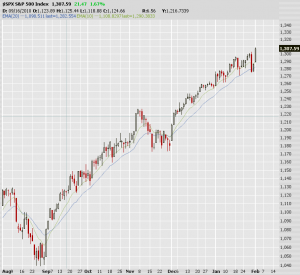

If we look at a chart of the VIX as compared to the S&P500, we see that the S&P made new highs, but the VIX has not come close to making new lows. If we cannot make new lows on the VIX, then this rally in the S&P will not hold.

0