Setting up Market Internals

The 4 core market internals consist of: Breadth Ratio Advance Decline Line Trin Tick You can use them to better pinpoint your entry and exits and get a good gauge of the market. In the video below I show how to setup market internals on the thinkorswim platform.

When NOT to Trade

Waiting patiently on the sidelines is one thing you hear some of the world’s greatest trader’s talk about in the book Stock Market Wizards. These are the times I’ve found best NOT to trade. When breadth is at parody, 1:1 When the a/d line is at parody, inside |400| When the tick is at parody, inside |400|

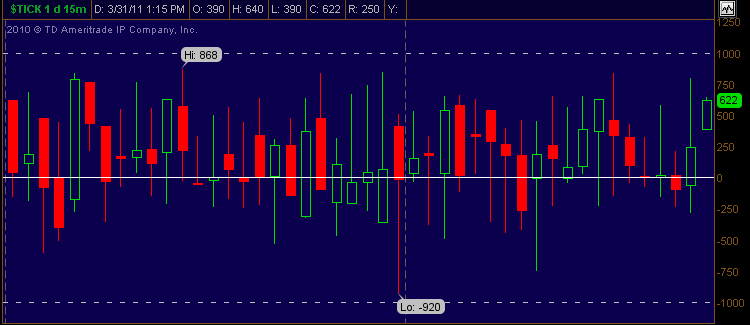

The NYSE Tick

The NYSE Tick Index is a short-term trading index which takes the difference in up ticking stocks from down ticking stocks. Here’s a video of live trading with the NYSE Tick. For example: if there are 2000 stocks trading on the NYSE and 1500 trade higher from the previous price and 500 trade lower from the previous price the Tick Index will read +500 (1500 – 500). Using the NYSE Tick The Tick Index is a used to and validate…