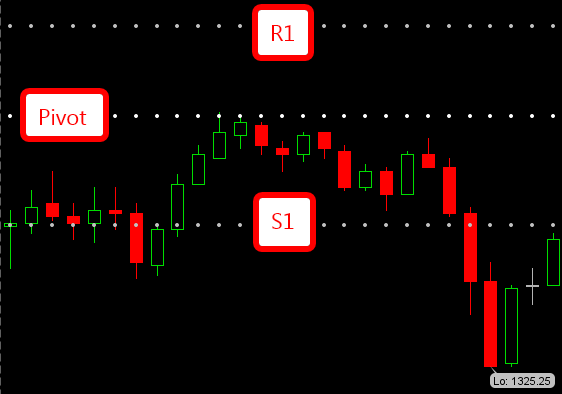

Day Trading with Pivot Points

The pivot point for the day is calculated by taking the prior day’s (High + Low + Close) / 3. These are commonly used by floor traders in the trading pits to identify key support and resistance levels. If the market opens above the daily pivot, look for short entries for a move down to test the pivot and vice versa. If the pivot isn’t tested in the morning session, then look for it to test in the afternoon. Daily…