A slow start today, but that’s normal for the first trading day of the new year. I wanted to begin this post by touching on some entry concepts for swing trades.

The Importance of the First 15-min Bar

The above is a 2 day 15-min chart of HSTM. This morning it was cued up in the long bin if it broke Friday’s high. It did, so why didn’t we go long? Look at the first 15-min bar. Here’s a trick to staying out of false gap up and gap down moves.

When we have a potential long and it gaps up above the prior day’s bar, we wait for that first 15-min candle to close and place our entry above the high of the first 15-min bar. In this case, the 15-min bar was the high of the day so we never got an opportunity to enter. The same is true for shorts only in reverse.

This little entry trick is very helpful and over time prevents entering into false moves.

Stocks to Watch on 1/4:

Longs: ABT, PG

Shorts: CRM, ESI, RMD, RUE

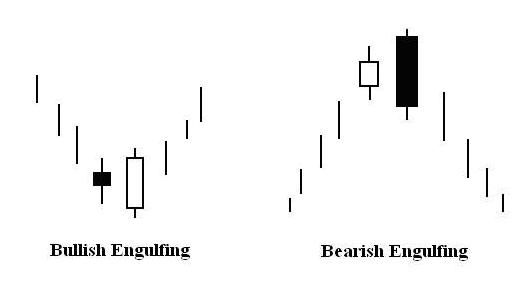

Notice that a lot of stocks produced a bearish engulfing pattern on their daily chart. This could be a sign of sector rotation meaning big firms and hedge funds are shifting out of these names and looking to cycle into lesser known stocks. Watch out for potential sharp corrections in these names.

Grab the RSS Feed to have the daily watch list delivered via email.