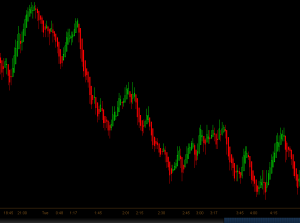

Buyers, Sellers vs. Bulls, Bears

You’ll notice the term buyers and sellers used in lieu of bulls and bears when talking about market moves. This is the correct way to relate to an up or down move in the market because we really have no idea whether it’s bulls or bears moving the market. Allow me to explain… John is bullish on the market, you could call him a bull, but he puts on a short position in the ES futures to hedge his long…